KnowBe4 to Acquire Egress

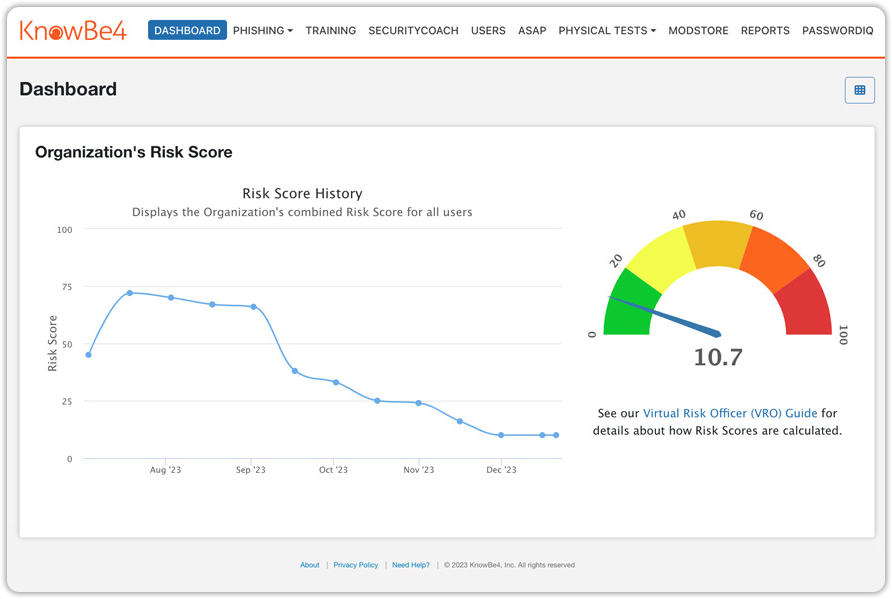

Strengthen Your Security Culture

Discover why 65,000+ organizations use the KnowBe4 platform to improve their security awareness training while reducing the risk that phishing and other social engineering threats pose.

NEW!

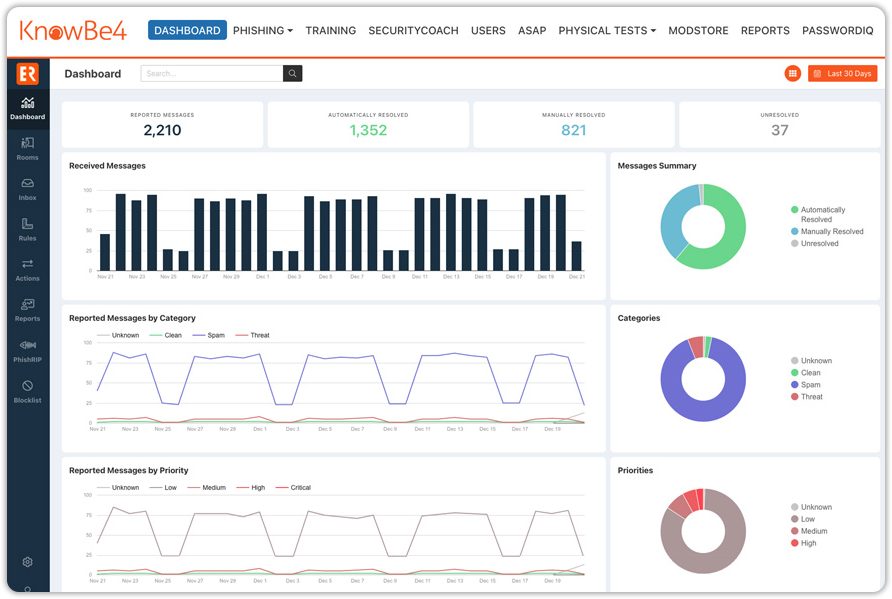

Supercharge Your Anti‑Phishing Defense

Tap Into the Power of 10+ Million Trained Users with Global Blocklist and Global PhishRIP.

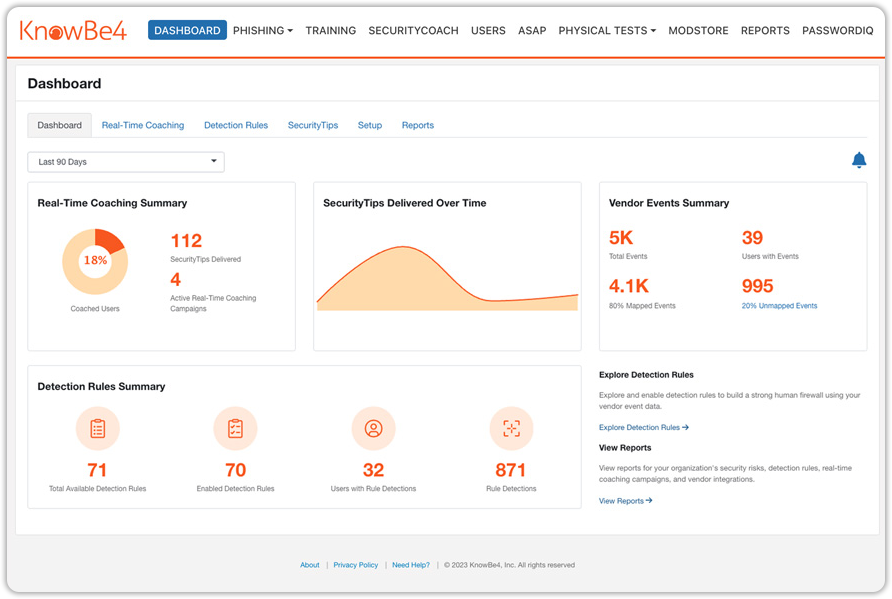

Deliver Real-Time Coaching in Response to Risky User Behavior With

See how you can improve your overall security culture and reduce human risk.

The Only Platform That Truly Addresses the Human Element of Cybersecurity

65K+

Over 65,000 organizations rely on KnowBe4 so employees remain vigilant of social engineering

50M+

50 million plus users everyday engage with the KnowBe4 platform to stay protected from bad actors

17M+

17 million email messages quarantined as malicious by PhishER Plus

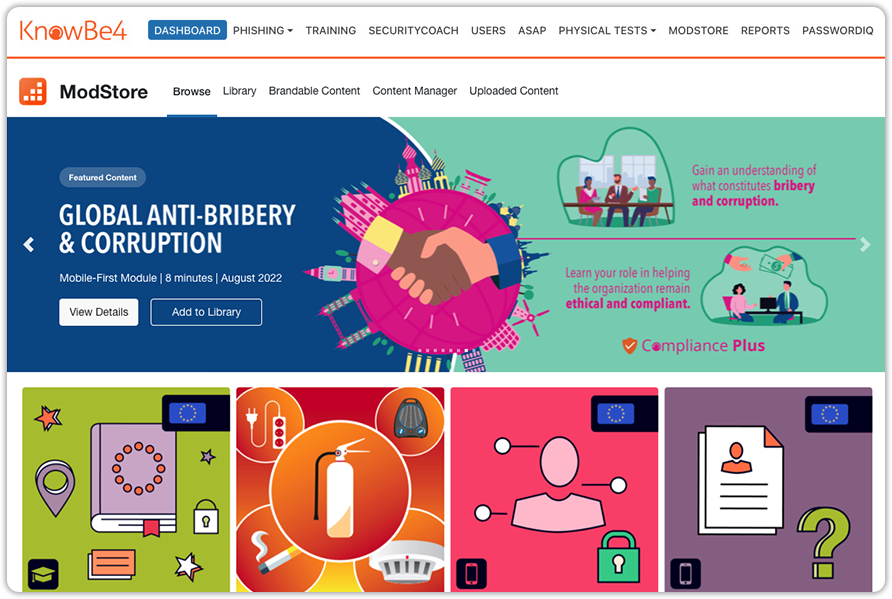

The King of Content

Customer Comes First

Always Fresh Content

Powered by AI

Comprehensive

Integrations

Customer Comes First

At KnowBe4, we take pride in making customer success our #1 priority. Your dedicated Customer Success Manager (CSM) will work with you to tailor your program requirements based on your organizational goals, objectives, and desired outcomes.

Always Fresh Content

Continuously updated, always-fresh, engaging, customized content is the foundational cornerstone for building a strong security culture at any organization, and no other vendor in the market provides a more expansive, diverse array of security awareness content than KnowBe4.

Powered by AI

From simulated phishing and security awareness training recommendations to real-time analysis and mitigation, AI and machine learning is at the heart of the KnowBe4 platform. This enables organizations to reduce risk faster, better and more efficiently.

Comprehensive

KnowBe4 is the only platform on the market that combines security awareness and compliance training and testing, simulated phishing, real-time coaching, and security orchestration to truly address the human element of cybersecurity.

Integrations

KnowBe4 works with leaders from across the IT and cybersecurity landscape to provide integrations to connect the KnowBe4 platform with systems and vendors that you already rely on

Free IT Security Tools

Test your users and your network with our free IT security tools which help you to identify the problems of social engineering, spear phishing and ransomware attacks.

Phishing Security Test

Did you know that 91% of successful data breaches started with a spear phishing attack?

Ransomware Simulator

Is your network effective in blocking ransomware and social engineering attacks?

Phish Alert Button

Do your users know what to do when they receive a suspicious email or attachment?

Training Preview

World's largest library of security awareness training content is now just a click away!

Recognized by Industry Experts & Trusted by Customers